3-Minute Breakdowns

Should you buy Uber stock? (January 2025)

3-Minute Breakdowns

•1-15-2025

DESCRIPTION

Published first at https://www.3minutebreakdowns.com

Uber stock analysis. Ticker: $UBER

Uber stock has fallen 16% over the last 3 months taking the company’s market value to 142 billion dollars. Account for cash, investments and debt and the enterprise value is 146 billion. Revenue over the last 12 months comes to 42 billion with 4.4 billion of net income and 6 billion of free cash flow. So Uber is currently valued at 3.5 times revenue, 32 times earnings and 24 times free cash flow.

Uber stock has fallen 15% over the past few months despite posting highly impressive growth. In the most recent quarter, Gross bookings on the platform hit 41 billion dollars representing four straight quarters of at least 20% growth. Revenue for Uber’s mobility segment was up 26%, delivery grew 18% and monthly users hit 161 million. Crucially, operating leverage means that Uber is now highly profitable. The company reported 1.7 billion of adjusted ebitda and 2.1 billion dollars of free cash flow in the last quarter alone.

#investing #stocks #stockstobuy

In Queue

UP NEXT

Adyen Stock Analysis (September 2023)

9-19-2023

Should you buy Costco stock? (June 2024)

6-5-2024

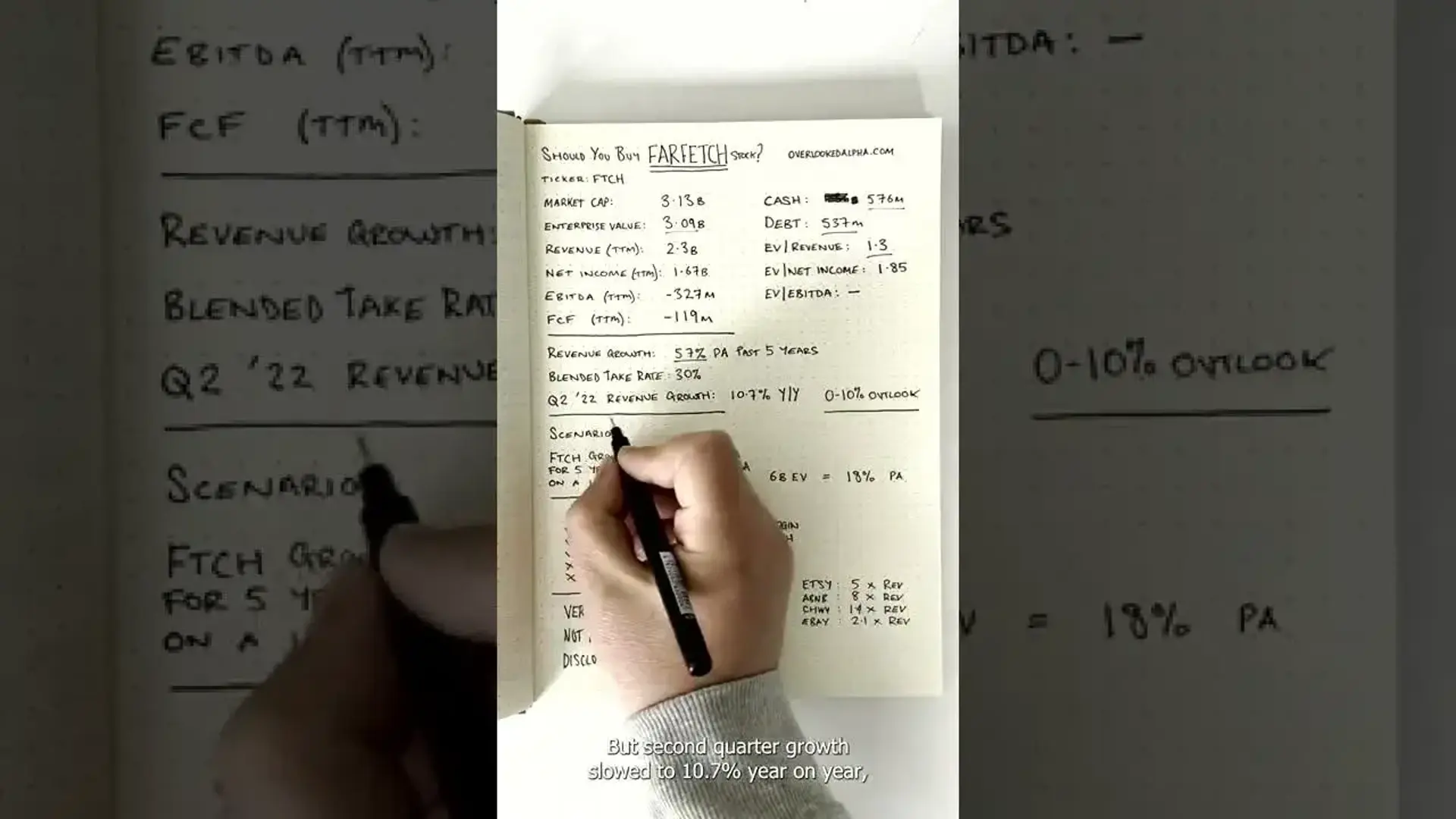

Should you buy Farfetch stock? #shorts

10-14-2022

Should you buy Duolingo stock? December 2025 - 3-Minute Analysis

12-4-2025