Should you buy Cava stock? (April 2025)

3-Minute Breakdowns

04/14/2025

Should you buy Cava stock? (April 2025)

Published first at https://www.3minutebreakdowns.com Cava stock analysis. Ticker: $CAVA Revenue over the last 12 months comes to 964 million with 130 million of net income, 126 million of adjusted ebitda and 53 million of free cash flow. So Cava stock is valued at over 10 times revenue and over 80 ...

Recommended Videos

Is Palantir Stock A Buy? #shorts

Should you buy Alibaba stock? #shorts

Rivian stock analysis #shorts

Should you buy Tesla stock? (February 2024)

Should you buy Snowflake stock? (March 2024)

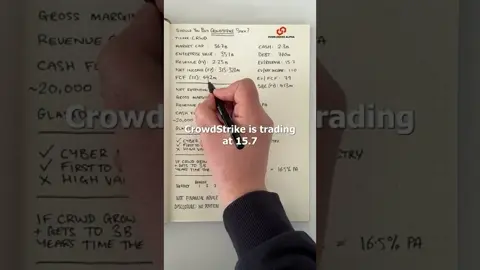

Should you buy CrowdStrike stock? #shorts

Should you buy Take-Two Interactive Stock? (October 2023)