3-Minute Breakdowns

Should you buy AEHR Test Systems stock? (May 2024)

3-Minute Breakdowns

•5-1-2024

DESCRIPTION

Published first at https://www.3minutebreakdowns.com

AEHR Test Systems stock analysis. Ticker: $AEHR

Between July 2021 and July 2023, Aehr Test Systems went up 20 times. Since then, shares have fallen over 75% taking the market cap to just 345 million dollars.

Revenue over the last 12 months comes to 72 million with 15 million of net income and just under 5 million of free cash flow. So Aehr stock doesn’t look too expensive at 4 times revenue or 22 times earnings.

The huge rally in Aehr stock may seem ridiculous but at the time it made sense. The company provides test solutions for the semiconductor industry and saw revenue soar by over 200% in 2022.

With a focus on silicon carbide wafers that are used in electric vehicles, Aehr helps reduce failure rates. Defective chips are identified well before they are placed in vehicles which is obviously hugely important for safety reasons. As the company tripled revenue in just a few years it’s not surprising that investors caught on to the stock. But over the last 8 months, the company has faced some major challenges.

Most obvious is that revenue growth has come to an abrupt end going from 206% in 2014 to just 14% over the last 12 months. Management has cut guidance multiple times and warned of pushouts from customers.

#stocks #investing #stockstowatch #3mb

In Queue

UP NEXT

Should you buy Mattel stock? (July 2023)

7-17-2023

Should you buy Apple stock? 3-minute analysis

11-3-2022

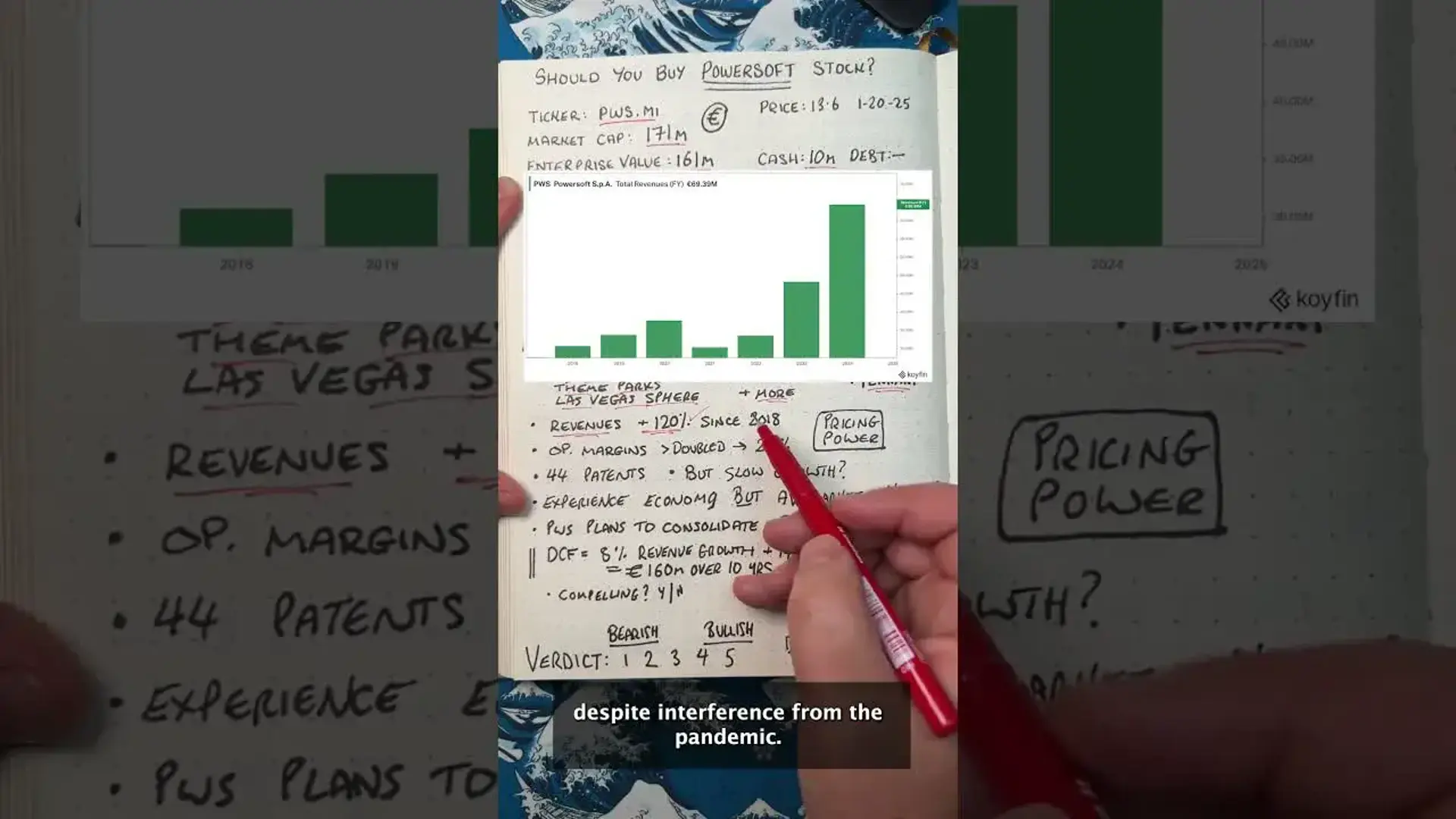

This small Italian stock is a hidden gem #stocks #stockmarket

1-23-2025

State Of The Stock Market - March 2025

3-14-2025