3-Minute Breakdowns

Should you buy Tesla stock? (April 2024)

3-Minute Breakdowns

•4-24-2024

DESCRIPTION

Published first at https://www.3minutebreakdowns.com

Tesla stock analysis. Ticker: $TSLA

Tesla just reported earnings and the stock jumped 10% but shares are still down 42% this year and 60% from their peak. Based on the after hours share price the company now has a market cap of 555 billion dollars with 22 billion of cash on the balance sheet and 2.7 billion of debt.

This was a concerning quarter for Tesla with automotive revenues dropping 13%. Unsurprisingly, given the huge cost of auto manufacturing, gross profit fell even further with an 18% decline. Operating margins fell again to just 5.5% which is lower than most legacy automakers, even General Motors. And Tesla’s free cash flow turned negative for the first time since 2019.

Of course, Tesla’s decision to cut prices is mostly to blame. But the company is also suffering from high interest rates and softening demand for electric vehicles.

Based on trailing twelve month figures, the company is now valued at almost six times revenue, 41 times earnings and almost 400 times free cash flow. In other words, Tesla stock still isn’t cheap despite falling 60%.

On the positive side, Elon Musk said on the conference call that total volume for this year would still be higher than the year before. He announced plans for more price cuts and new cheaper models to roll out next year. The company has laid off 10% of staff, postponed a trip to India and will be utilizing existing factories to build new models which will help keep costs down.

#teslastock #stockanalysis #investing #stockstobuy

In Queue

UP NEXT

Should you buy Opendoor stock? (July 2024)

7-13-2024

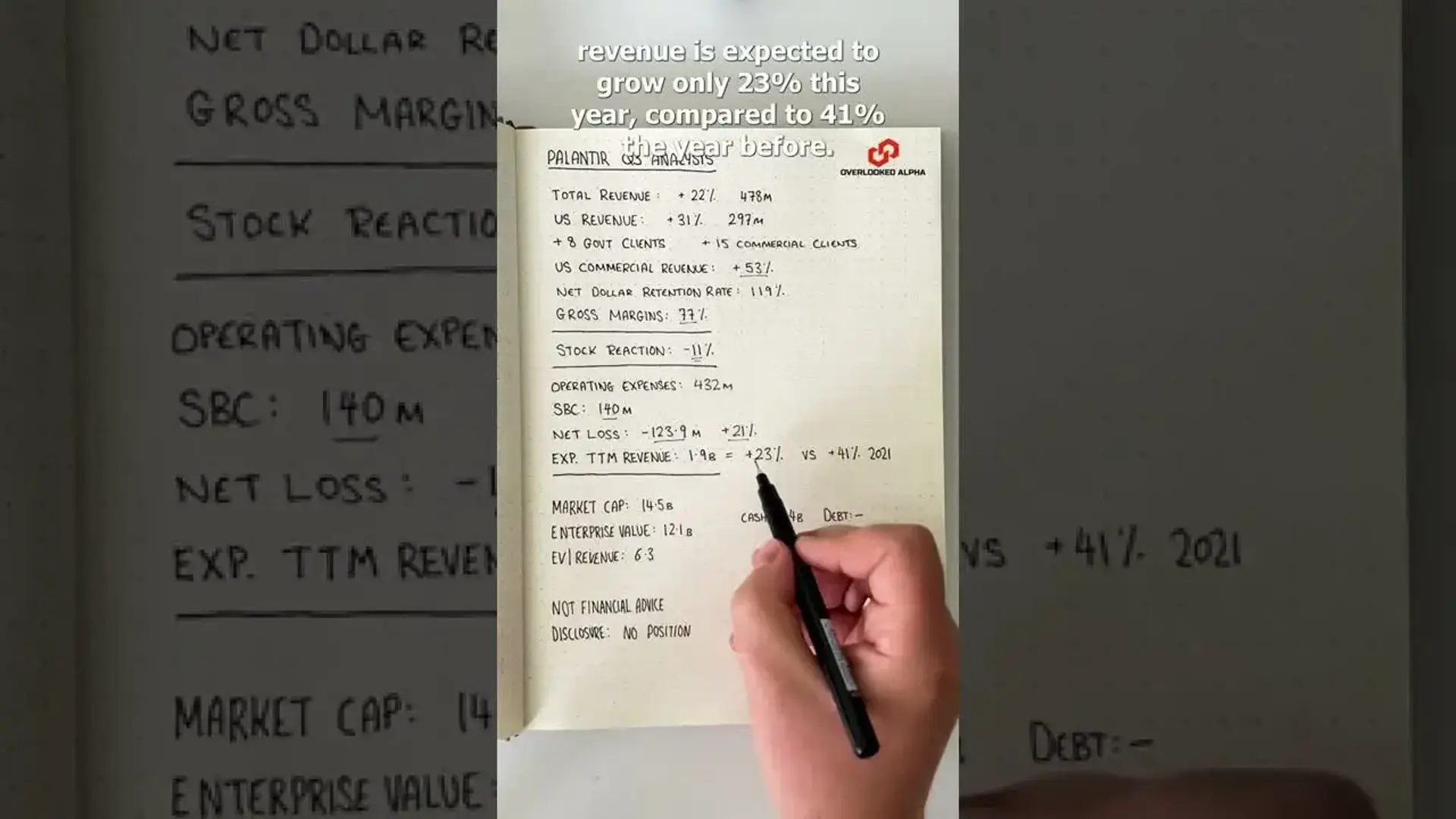

Palantir Stock Q3 Update #shorts

11-8-2022

State Of The Stock Market - April 2025

4-5-2025

Should you buy Carvana stock? 3-Minute Stock Analysis - June 2025

6-12-2025