3-Minute Breakdowns

Should you buy MicroStrategy stock? (April 2024)

3-Minute Breakdowns

•4-3-2024

DESCRIPTION

Published first at https://www.3minutebreakdowns.com

MicroStrategy stock analysis. Ticker: $MSTR

Software company MicroStrategy has had an incredible 12 months. Over the past year, the stock has increased in value by 465% and based on the number of shares outstanding the company’s market value is now 33.6 billion.

Software revenue over the last 12 months comes to 500 million with 429 million of net income. However, net income was impacted by a one-off tax benefit. Operating income last year was actually negative 45 million and free cash flow was only 10 million.

And since the company’s software revenue hasn’t grown in over 10 years, the question is why does the company command such a high valuation?

The answer is that in 2020, MicroStrategy embarked on a new strategy where it would use company funds to accumulate bitcoin. And based on latest company filings, the company now owns 214,246 bitcoins. So at the current bitcoin price, just under $66 thousand, the stash is worth just over 14 billion. And incredibly, since bitcoin production is capped at 21 million, the company owns more than 1% of all the bitcoin that will ever be mined.

Yet MicroStrategy’s valuation still implies a major disconnect. Because if the company’s bitcoins are worth 14 billion, that implies the software business is worth almost 20 billion or 40 times sales. That valuation doesn’t make sense considering the software business has shown little growth. Even if bitcoin was worth $100.000 dollars the company’s market cap still wouldn’t make a lot of sense.

#mstrstock #investing #stockstowatch #bitcoin #3mb

In Queue

UP NEXT

Should you buy Airbnb stock? (January 2024)

1-8-2024

Should you buy Tesla stock? (July 2024)

7-29-2024

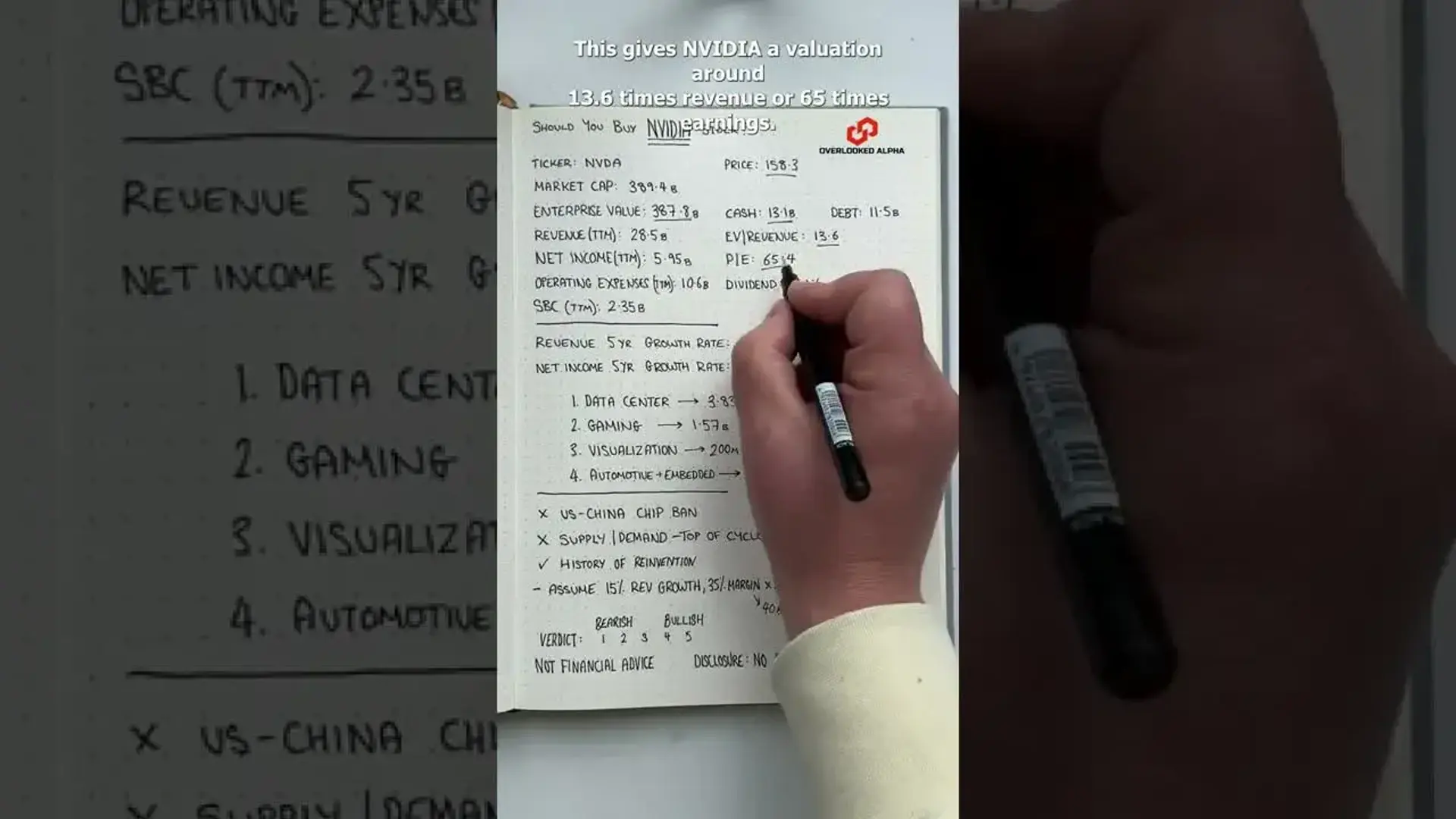

Nvidia stock analysis #shorts

11-29-2022

Should you buy Ulta Beauty stock? (March 2025)

3-20-2025